How do we keep this site running? This post may contain affiliate links, for which we may receive a referral fee. The cost is the same to you and any compensation we may receive does not affect our reviews or rankings. Thanks!

Most people are familiar with TurboTax, which is the top personal tax preparation software in the U.S. What many people don’t know is there are two ways to use TurboTax. The online version at TurboTax.com, and the desktop version, which you install on a PC or Mac.

What’s the difference between TurboTax Desktop and TurboTax Online?

Here are a few of the major differences between the two:

TurboTax Online

- Everything is stored in the cloud at TurboTax.com

- Accessed through a web browser

- Must be online to use it

- Doesn’t import data from Quicken or QuickBooks

- Can prepare 1 federal tax return

- No business returns (LLC, S or C Corp, Estate, or Trust)

- Limited number of stock transaction

TurboTax Desktop

- Installs on a PC or Mac, no web browser required

- Imports data from Quicken or QuickBooks

- You can prepare and efile 5 federal returns with no additional cost (perfect for households with multiple returns)

- You can prepare and paper file unlimited returns

- Allows you to ammend prior years’ returns

- Your sensitive financial information is not stored in the cloud

- Can handle more than 500 stock transactions

- Can prepare returns for a business (LLC, partnership, corporation, estate, or trust)

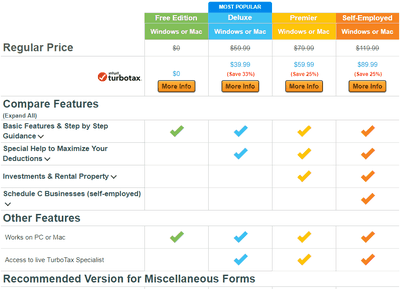

TurboTax Online Editions:

Nothing to install, complete your return online. Start for FREE, pay when you file.

Free Edition

Simple tax returns

$0 Fed. $0 State. $0 File.

File for $0

1 federal & 1 state e-file included

Deluxe Most Popular

Maximize tax deductions & credits

$59.99

Start for Free

1 federal e-file. State additional.

Self-Employed

Personal & Business income and expenses

$119.99

Start for Free

1 federal e-file. State additional.

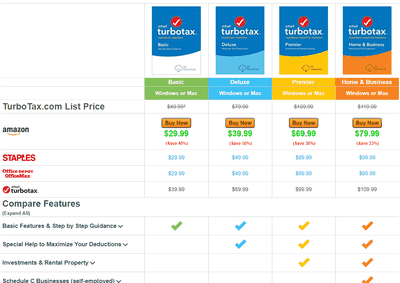

TurboTax Desktop Editions:

Install on Windows or Mac. E-file up to 5 federal returns.

Basic

Simple tax returns

5 federal e-files. State additional.

Deluxe Most Popular

Maximize tax deductions & credits

5 federal e-files. 1 state download $10 extra.

Premier

Investments and rental property

5 federal e-files. 1 state download included.

Home & Business

Personal & Self-Employed income and expenses

$119.99

Buy Now

5 federal e-files. 1 state download included.

This helpful table from https://ttlc.intuit.com/questions/1901030-turbotax-online-vs-turbotax-cd-download-software shows some of the advantages and disadvantages of Online vs Desktop versions of TurboTax

| TurboTax Onlne editions | TurboTax CD/Desktop editions | |

| Cost | ||

| One return for each sign-in. Form 1040-EZ or 1040-A with standard deductions and no state or add-ons is free with TurboTax Free edition. |

Efile up to 5 family or personal returns. (Useful if doing joint federal and separate state returns for example.) |

|

| Try before you buy, pay for TurboTax plus or Deluxe and above when you efile or print your return. | Buy before your try with a 60 day money back guarantee! | |

| Each state is extra and includes efiling. | One free state is usually included with Deluxe, Premier, & Home and Business editions (each state efile is extra). | |

| Can efile one federal and up to 5 state returns. | Efile up to 5 federal returns, each with up to 3 state returns. | |

| Computer Stuff | ||

| Online system requirements are usually lower, a current browser and internet access should be good. | System requirements are usually higher, see Windows requirements or Mac requirements. | |

| TurboTax securely handles storage and backups (pay for TurboTax Plus or Deluxe and above for access to prior tax year returns). | You manage your own stoarage and backups. | |

| Prepare and file taxes from any Internet device. Even smart phones, iPads and tablets! Check out our new mobile apps for iOS and Android. | TurboTax requires a Windows or Mac computer system with Internet access for program updates, help articles, and efiling. | |

| TurboTax Online is always up-to-date; you see the latest forms and tax information. | The latest upates will load when you access the internet. | |

| Other Considerations | ||

| Requires a unique User ID and password for each return. And you must remember it from one year to the next to access last years tax information. | Tax files are available as long as you have a computer and the program, and you keep your tax files (remember to keep backups). |

Compare Versions of TurboTax

Whichever you decide to use, TurboTax Online or TurboTax Desktop, you’ll be using the best tax preparation software available to ensure you get the biggest refund and save the most on your taxes.

Click a chart below to compare prices and features for either the Desktop or Online versions of TurboTax:

Nate Phillips has been using Quicken and TurboTax for over 20 years. He has spent part of that time as a Quicken beta tester, helping identify bugs and annoyances with Quicken updates before they are released. Nate holds a master’s degree in Computer Science and has numerous technology certifications.